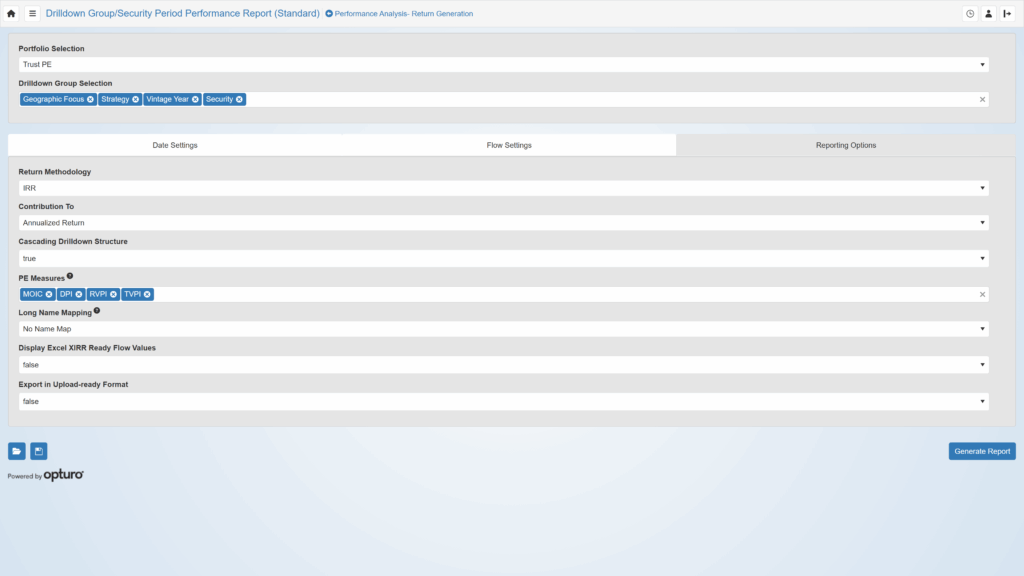

Performance Analysis / Return Generation

Portfolio level performance using market values and inflows/outflows may be calculated within the SAYS platform using, at the portfolio level, either multi-period Dietz or exact IRR methodologies or an exact TWR method if valuations are available on each day with a flow.