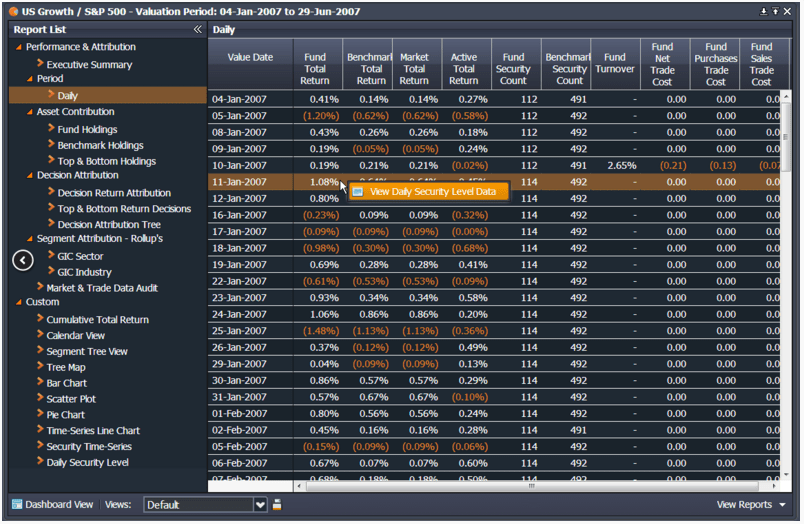

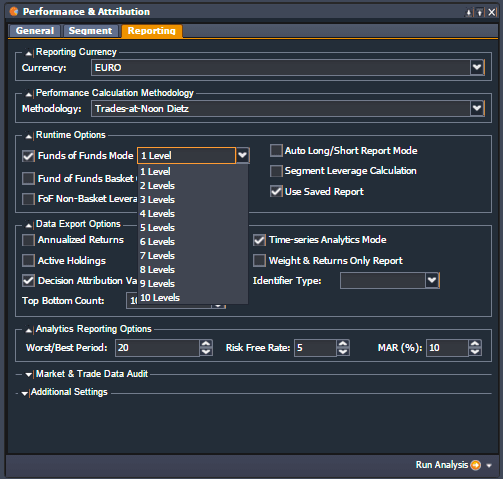

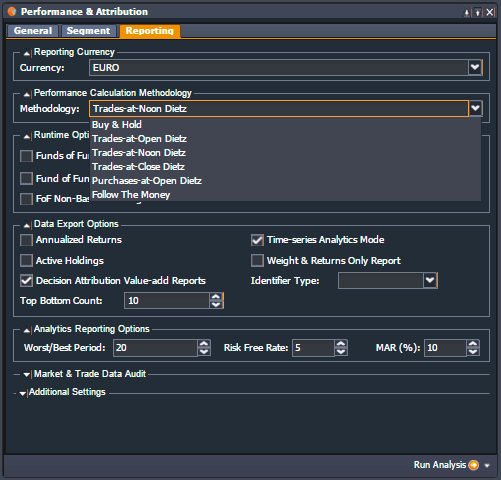

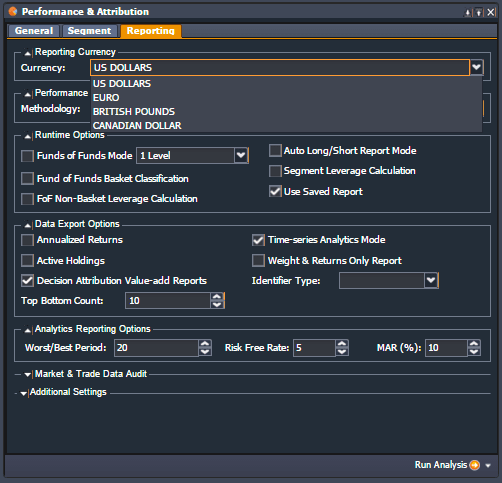

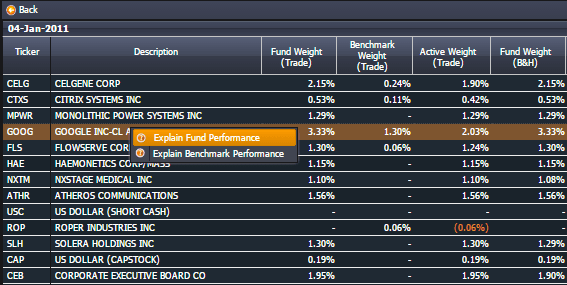

Opturo Performance is exact and built upon daily, component-level, trade-inclusive, multi-currency returns for both longs and shorts, and notional products. The analytics incorporate corporate actions, overnight cash flows and tax reclaim to provide accurate weights and returns for performance reporting and attribution while resolving notorious difficulties arising from intra-day transactions.

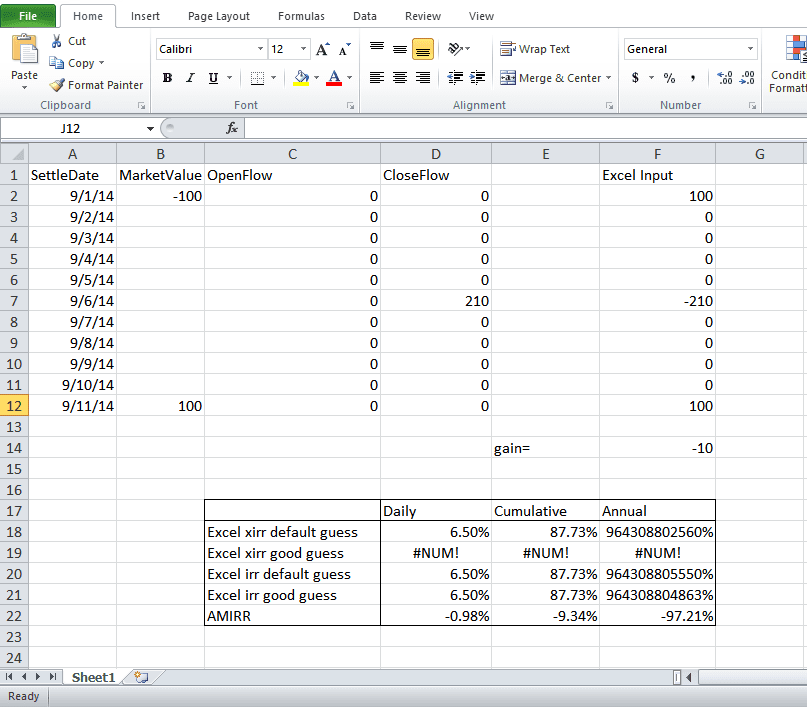

The AMIRR process that Opturo employs for calculating the money-weighted “Internal Rate of Return” (IRR) of a portfolio or segment thereof, enhances and corrects standard IRR calculations, such as those employed by Excel. As such, it is an indispensable tool for any performance measurement process concerned with money weighted returns, including segment, sector and/or security level short positions. Download sample segment drill-down report and source data of our IRR Calculations.

Performance and attribution terms are carefully made economically meaningful, avoiding the all-too-common critical calculation problems endemic in popular competing platforms. Opturo Performance correctly calculates the component-level returns for any possible transaction combination of sales, purchases, flips and shorts. The return for every instrument has the same sign as its gain and is never below -100%. Opturo also offers Real-Time Performance, which enables users to monitor intraday performance and integrate 3rd party data into a single reporting interface. Also, Opturo Performance leverages unparalleled data transparency within the platform to provide Middle and Back Office professionals with the tools required to Support and Reconcile all performance data and calculations.